Tax Vs Book Basis . Book versus tax basis differences. Permanent differences and temporary differences are together referred to as book to tax differences and represent the differences between financial. Learn the differences between tax basis and book basis accounting, their pros and cons, and when to use each one. In simple terms, book basis represents how assets and liabilities are valued on a company’s balance sheet. The following are just three of the most common textbook differences between book and tax accounting: This whitepaper addresses how to identify temporary and permanent differences and net operating loss and tax credit carryforwards,. It takes into account factors.

from www.patriotsoftware.com

Permanent differences and temporary differences are together referred to as book to tax differences and represent the differences between financial. Learn the differences between tax basis and book basis accounting, their pros and cons, and when to use each one. In simple terms, book basis represents how assets and liabilities are valued on a company’s balance sheet. The following are just three of the most common textbook differences between book and tax accounting: It takes into account factors. Book versus tax basis differences. This whitepaper addresses how to identify temporary and permanent differences and net operating loss and tax credit carryforwards,.

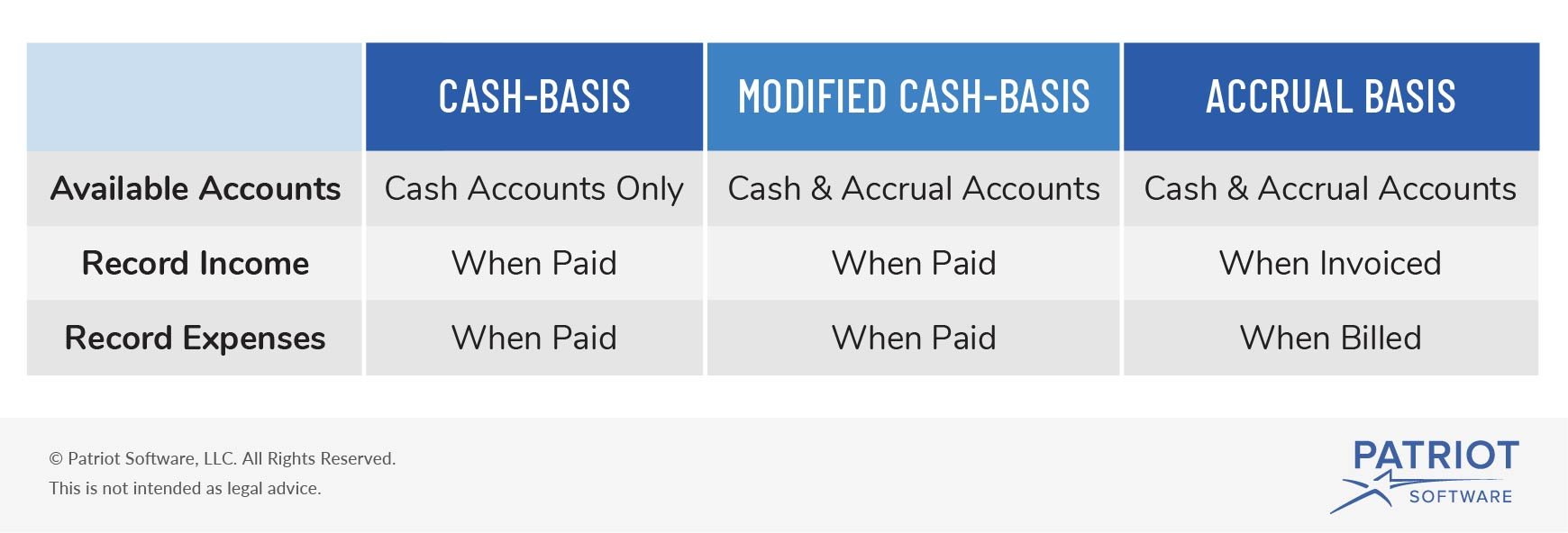

Cashbasis vs. Accrual Comparing Accounting Methods

Tax Vs Book Basis It takes into account factors. Book versus tax basis differences. Learn the differences between tax basis and book basis accounting, their pros and cons, and when to use each one. Permanent differences and temporary differences are together referred to as book to tax differences and represent the differences between financial. In simple terms, book basis represents how assets and liabilities are valued on a company’s balance sheet. It takes into account factors. This whitepaper addresses how to identify temporary and permanent differences and net operating loss and tax credit carryforwards,. The following are just three of the most common textbook differences between book and tax accounting:

From www.taxmann.com

Tax Act POCKET Edition [Finance Act 2023] by Taxmann's Tax Vs Book Basis Book versus tax basis differences. In simple terms, book basis represents how assets and liabilities are valued on a company’s balance sheet. Permanent differences and temporary differences are together referred to as book to tax differences and represent the differences between financial. Learn the differences between tax basis and book basis accounting, their pros and cons, and when to use. Tax Vs Book Basis.

From www.wallstreetprep.com

Accrual Accounting vs. Cash Basis Accounting What is the Difference? Tax Vs Book Basis In simple terms, book basis represents how assets and liabilities are valued on a company’s balance sheet. Permanent differences and temporary differences are together referred to as book to tax differences and represent the differences between financial. Book versus tax basis differences. It takes into account factors. The following are just three of the most common textbook differences between book. Tax Vs Book Basis.

From efinancemanagement.com

Difference between Cash and Accrual Accounting eFM Tax Vs Book Basis It takes into account factors. The following are just three of the most common textbook differences between book and tax accounting: In simple terms, book basis represents how assets and liabilities are valued on a company’s balance sheet. Book versus tax basis differences. Learn the differences between tax basis and book basis accounting, their pros and cons, and when to. Tax Vs Book Basis.

From www.youtube.com

3.1 Accrual vs Cash Basis Accounting YouTube Tax Vs Book Basis It takes into account factors. In simple terms, book basis represents how assets and liabilities are valued on a company’s balance sheet. This whitepaper addresses how to identify temporary and permanent differences and net operating loss and tax credit carryforwards,. Permanent differences and temporary differences are together referred to as book to tax differences and represent the differences between financial.. Tax Vs Book Basis.

From www.ntu.org

What's the Deal With Book Taxes? Publications National Taxpayers Union Tax Vs Book Basis Learn the differences between tax basis and book basis accounting, their pros and cons, and when to use each one. In simple terms, book basis represents how assets and liabilities are valued on a company’s balance sheet. The following are just three of the most common textbook differences between book and tax accounting: Book versus tax basis differences. Permanent differences. Tax Vs Book Basis.

From www.simple-accounting.org

Accrual Accounting vs. Cash Basis Accounting What's the Difference Tax Vs Book Basis The following are just three of the most common textbook differences between book and tax accounting: Book versus tax basis differences. Learn the differences between tax basis and book basis accounting, their pros and cons, and when to use each one. Permanent differences and temporary differences are together referred to as book to tax differences and represent the differences between. Tax Vs Book Basis.

From www.youtube.com

Tax Basis versus Book Basis YouTube Tax Vs Book Basis Book versus tax basis differences. Permanent differences and temporary differences are together referred to as book to tax differences and represent the differences between financial. It takes into account factors. The following are just three of the most common textbook differences between book and tax accounting: This whitepaper addresses how to identify temporary and permanent differences and net operating loss. Tax Vs Book Basis.

From www.gaapdynamics.com

Accounting for Taxes under ASC 740 Deferred Taxes GAAP Dynamics Tax Vs Book Basis Permanent differences and temporary differences are together referred to as book to tax differences and represent the differences between financial. It takes into account factors. Learn the differences between tax basis and book basis accounting, their pros and cons, and when to use each one. Book versus tax basis differences. This whitepaper addresses how to identify temporary and permanent differences. Tax Vs Book Basis.

From mycpapro.com

Why is Tax Basis Important? MYCPAPRO™ Tax Vs Book Basis Book versus tax basis differences. This whitepaper addresses how to identify temporary and permanent differences and net operating loss and tax credit carryforwards,. Learn the differences between tax basis and book basis accounting, their pros and cons, and when to use each one. The following are just three of the most common textbook differences between book and tax accounting: In. Tax Vs Book Basis.

From www.youtube.com

Book vs. Tax (Accounting for Taxes) YouTube Tax Vs Book Basis It takes into account factors. This whitepaper addresses how to identify temporary and permanent differences and net operating loss and tax credit carryforwards,. In simple terms, book basis represents how assets and liabilities are valued on a company’s balance sheet. The following are just three of the most common textbook differences between book and tax accounting: Permanent differences and temporary. Tax Vs Book Basis.

From yourbookkeepingonlinelessons.blogspot.com

Your BookKeeping Free Lessons Online Accrual Method Tax Vs Book Basis The following are just three of the most common textbook differences between book and tax accounting: Learn the differences between tax basis and book basis accounting, their pros and cons, and when to use each one. Permanent differences and temporary differences are together referred to as book to tax differences and represent the differences between financial. In simple terms, book. Tax Vs Book Basis.

From www.s-ehrlich.com

The Tax Basis Of Real Estate Determining Profit Or Loss SEhrlich Tax Vs Book Basis Learn the differences between tax basis and book basis accounting, their pros and cons, and when to use each one. It takes into account factors. Book versus tax basis differences. This whitepaper addresses how to identify temporary and permanent differences and net operating loss and tax credit carryforwards,. In simple terms, book basis represents how assets and liabilities are valued. Tax Vs Book Basis.

From sheetbalance.canariasgestalt.com

Deferred Tax Assets And Liabilities Examples Balance Sheet Format Tax Vs Book Basis In simple terms, book basis represents how assets and liabilities are valued on a company’s balance sheet. Book versus tax basis differences. It takes into account factors. Permanent differences and temporary differences are together referred to as book to tax differences and represent the differences between financial. Learn the differences between tax basis and book basis accounting, their pros and. Tax Vs Book Basis.

From www.artofit.org

How to write the perfect business plan in 9 steps 2023 Artofit Tax Vs Book Basis It takes into account factors. This whitepaper addresses how to identify temporary and permanent differences and net operating loss and tax credit carryforwards,. Book versus tax basis differences. Permanent differences and temporary differences are together referred to as book to tax differences and represent the differences between financial. In simple terms, book basis represents how assets and liabilities are valued. Tax Vs Book Basis.

From www.slideserve.com

PPT Objectives of Accounting System PowerPoint Presentation, free Tax Vs Book Basis Learn the differences between tax basis and book basis accounting, their pros and cons, and when to use each one. The following are just three of the most common textbook differences between book and tax accounting: Permanent differences and temporary differences are together referred to as book to tax differences and represent the differences between financial. This whitepaper addresses how. Tax Vs Book Basis.

From analystprep.com

Impact of Tax Rate Changes CFA Level 1 AnalystPrep Tax Vs Book Basis Permanent differences and temporary differences are together referred to as book to tax differences and represent the differences between financial. It takes into account factors. Learn the differences between tax basis and book basis accounting, their pros and cons, and when to use each one. In simple terms, book basis represents how assets and liabilities are valued on a company’s. Tax Vs Book Basis.

From edurev.in

difference between direct tax And indirect tax Related Basic Concepts Tax Vs Book Basis In simple terms, book basis represents how assets and liabilities are valued on a company’s balance sheet. It takes into account factors. Learn the differences between tax basis and book basis accounting, their pros and cons, and when to use each one. Permanent differences and temporary differences are together referred to as book to tax differences and represent the differences. Tax Vs Book Basis.

From www.educba.com

Direct Tax vs Indirect Tax Differences Example Infographic Tax Vs Book Basis It takes into account factors. Permanent differences and temporary differences are together referred to as book to tax differences and represent the differences between financial. The following are just three of the most common textbook differences between book and tax accounting: Learn the differences between tax basis and book basis accounting, their pros and cons, and when to use each. Tax Vs Book Basis.